Why Chart Reading is Important

Trading is a challenging task, but proper risk management can help ensure consistent profits. However, this is possible only if the trader develops a proper mindset to reading charts. The ability to read and analyze charts not only boosts a trader's morale but also helps one acknowledge the risk involved.

Let us try to understand it with recent examples:

1. Adani Enterprises Ltd (NSE:ADANIENT)

#ADANIENT gave a breakdown at 3228 as shown in the chart below.

It gave a movement of 68% in one week and made a low of 1017. Look at the fall:

However many traders were looking a buy entry at every dip. After buying, they were listening to analysts at various new channels to support their buying decision.

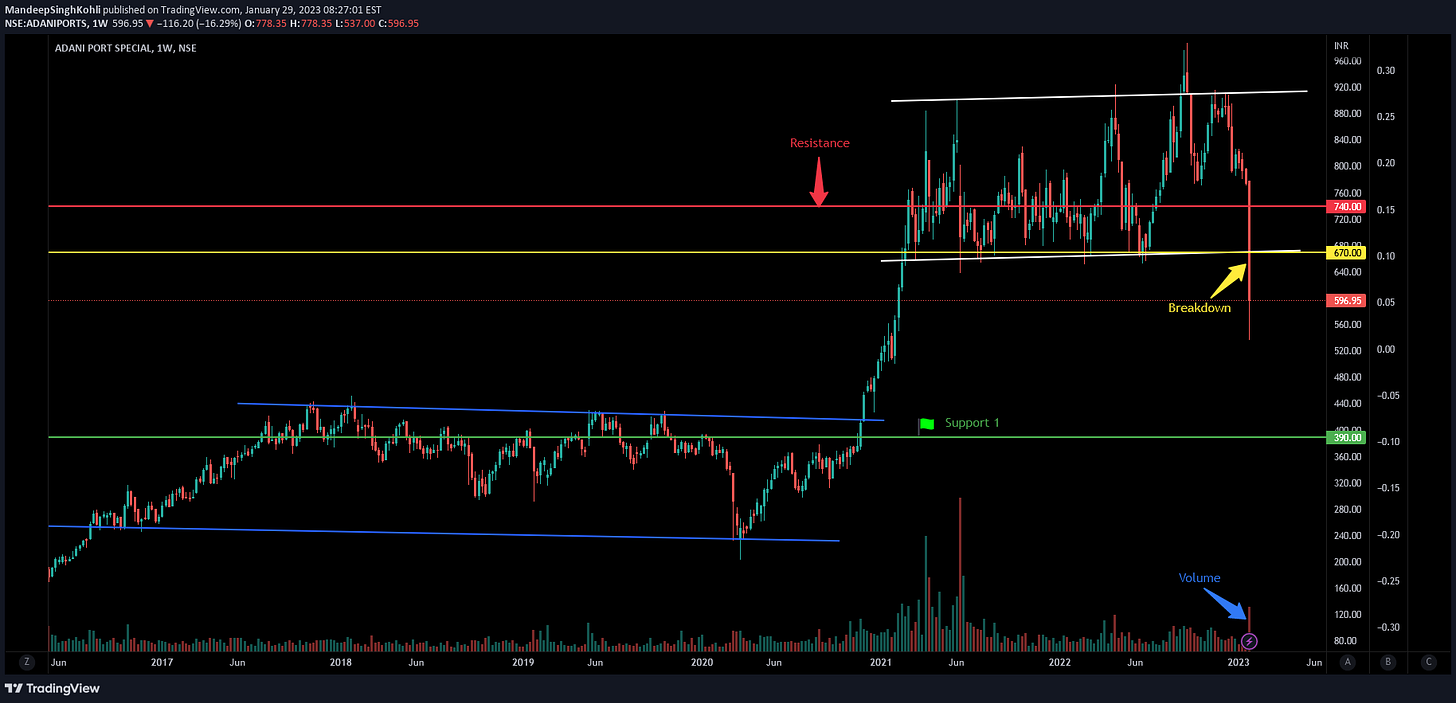

2. Adani Ports And Special Economic Zone (NSE:ADANIPORTS)

#ADANIPORTS gave a breakdown at 596.95 as shown in the chart below:

It gave a movement of 34% in a single week and made a low of 395.25. Look at the chart:

Adani stocks are recently in limelight. There is a lot of buzz if one should buy these stocks or not. No one knows what the price will be tomorrow, however, one can take a clue from chart reading.

While people were busy in listening to analysts about their views and buying the stock, traders who are efficient in chart reading were making gains based on their chart reading skills.

3. Manaksia Ltd (NSE:MANAKSIA)

#MANAKSIA gave a breakout at 92.45 as shown in the chart below:

It gave a movement of 45% in a single week. Look at the chart below:

4. ISMT Ltd (NSE:ISMT)

#ISMT gave a move of 15% in a single week. Look at the chart below:

Not every chart will move that fast every week, however, you will find all big gainers from these chart patterns only. Few will move 10, 15 or 50% in a week and others may take many weeks to achieve these targets.

Trading is a game of probability. Based on fundamental and technical studies, pick best stocks on the basis of chart reading and then wait for these stocks to achieve their targets. (Avoid high debt companies, penny stocks, companies with high promoter pledging on long side as these all are considered negatives.)

Success doesn't lie in taking trade every single day or week. Success lies in understanding a chart setup, entering the trade with a trading plan, have conviction in it and give it time to ripe. Whenever, we are entering in a trade, it is like we are sowing a seed. So, it will take time before they germinate and provide us some fruits. Some of these will provide early fruits and some will take a little longer (Some even may spoil and obviously we will replace them). So, just have patience and trust your trade setup. It will be helpful in long run.

If you like our charts and want to be a part of these success stories, you are most welcome to join us here:

Best Regards,

Team 9amPrime