“Compound interest is the eighth wonder of the world. He who understands it, earns it, he who doesn't, pays it.

- Albert Einstein

A paisa that doubles every day

Let us understand it this way. Suppose you are given two options to choose from:

Option 1: Take a paisa now which will get doubled each day for next 31 days.

Option 2: Take Rs. 1 million now in cash (1 million = Rs. 10 Lakhs)

What will you choose?

Let us make it easy for you..

Hint - If you take a paisa now which will get doubled each day, by day 16, you will have less than Rs. 350/- and more than half of the month is gone.. 🤔🤔

Hmm.. it may not look that difficult and many of us may opt for 1 million now in cash.

But wait... Now check this Math:

That is really awesome! A paisa that doubles 30 times would be worth more than Rs. 1.07 crores.

IMP: It pays to be wise with your money and no matter how small the start, it is regular growth that matters. While the going may seem slow for the first few years, the same small corpus can become a handsome pile of cash in later years.

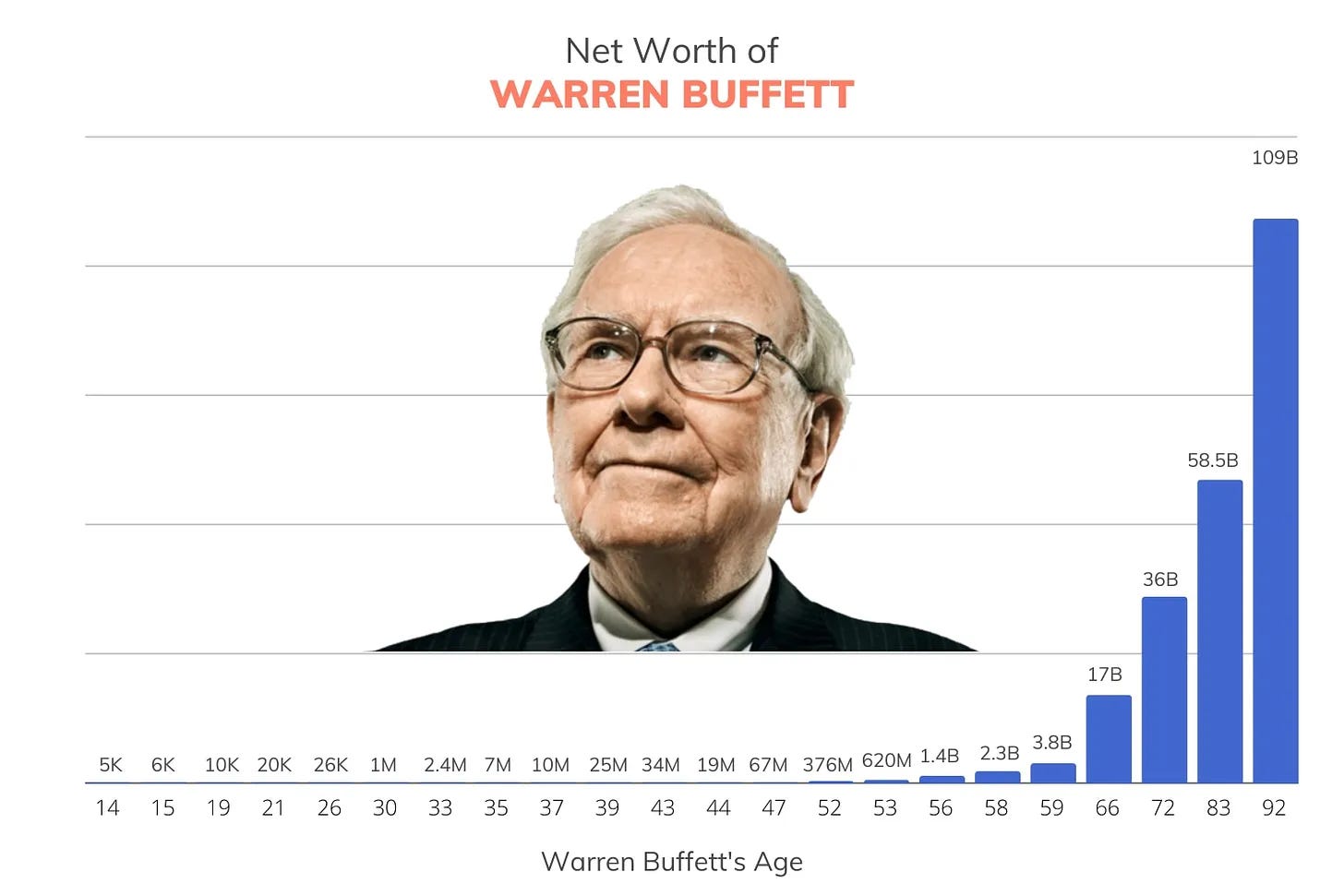

Now look, how Warren Buffett’s wealth has grown over years using this simple formula of compounding:

Isn’t it mind blowing..😳

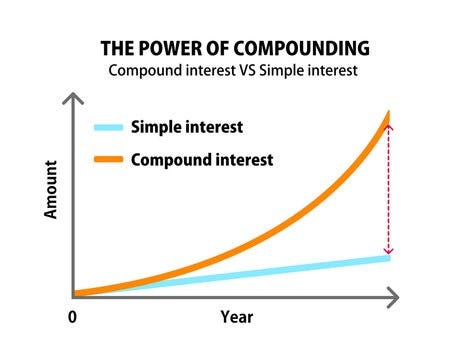

Compounding in the World of finance refers to the ability of money to grow itself. It builds upon the fact that money can grow exponentially when you keep reinvesting your profits. Assuming the gains of year 1 get reinvested for year 2, gains of year 2 gets reinvested for year 3, gains of year 3 gets reinvested for year 4 and so on.

Compounding is a powerful way to build wealth. It’s when the earnings from your investments get added to your original investment pile (reinvested) and those earnings then build upon themselves. Over time, these returns can compound on themselves, creating a snowball effect of growth.

Compounding is most commonly associated with long-term investing, such as investing in stocks, bonds or mutual funds. When investors reinvest their dividends or interest payments, they can take advantage of compounding to accelerate the growth of their investments. Compounding basically denotes how money makes money over a long period of time.

Compounding in Equity Trading

Now it is up to you how you can use this concept of compounding to grow your portfolio.

One way to grow your money is by investing in mutual funds. Assuming your money is growing at a 20% annual rate, you will get following amount at the end of 21 years:

However, you can shorten this time by trading in stock market. Instead of waiting for 21 years, you can get this return by the end of 21 successful trades. Now these 21 trades can take a time of 3-5 years approximately. Remember, there will be lost trades in the journey and actual number of trades might be more than 21.

Also, it all depends on your skills and understanding of the stock market.

Similarly, if you book profit at 25% in every trade, after 21 trades, your Rs. 1 Lac will grow to 1.08 crores.

Here is the Math:

Now to get this kind of returns, it is better to develop your understanding of the stock market. The above illustrations just show the potential of stock market as well as compounding.

✅ When your skills in stock market are combined with this concept of compounding, it can turn into a money machine.

To sum up:

Compound interest is the eight wonder of the world

Spend quality time in understanding the stock market

Choose right investment or trading tools

Have patience

Maintain the Discipline..

Warren Buffett has rightly said:

"If you don't find a way to make money while you sleep, you will work until you die."

Remember you can work 9-5 for money, but your money can work 24*7 by being invested and experiencing the fruits of compounding.